Quick & Compliant Motor Vehicle Record Checks

Unveil an individual’s driving history, safety record, and driving eligibility. Comply with FMCSA and FCRA regulations. All in one background check.

Mitigate Risk & Put Safe Drivers Behind the Wheel with MVR Checks

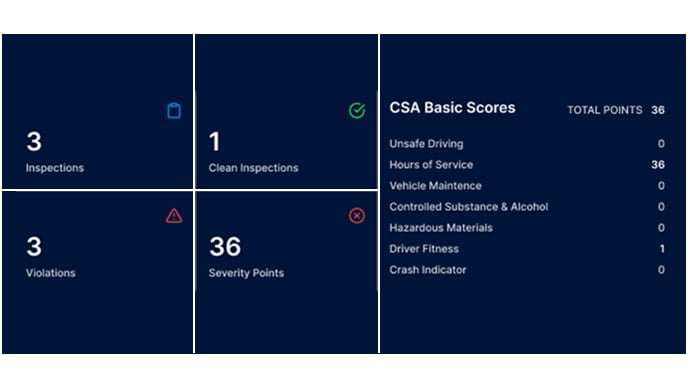

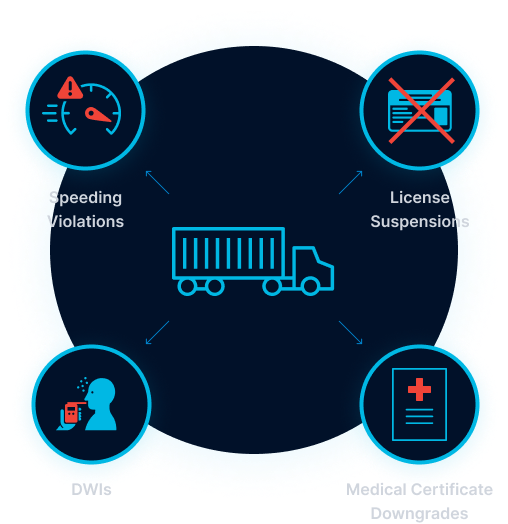

Foley’s single commercial MVR check reveals license expirations, statuses, classes, endorsements, restrictions, violations, accidents, vehicular crimes, suspensions — even unpaid parking tickets and child support. Continuously track violations with our MVR Monitor.

Why Should You Check Your Drivers' MVR Reports?

Why Should You Check Your Drivers' MVR Reports?

Identify High-Risk Candidates & Drivers

Make smarter hiring decisions by looking into an applicant’s driving history. Regular MVR checks help keep tabs on your drivers’ habits so you can take corrective action, if needed.

Fulfill Annual DOT MVR Check Requirement

If you’re wondering, “How do I get an MVR report?” Foley is your first step. We’ll run MVR checks for all your drivers so you can have peace of mind about your yearly compliance requirements.

Reduce Your Company’s Risk Profile

The more drivers you employ, the more susceptible your company is to violations, crashes, and litigation. Protect your business from MVR violations and potentially lower insurance costs.

Comply with State & Federal Regulations

Since an MVR check is a consumer report, employers must comply with the Fair Credit Reporting Act, including disclosure and authorization requirements and adverse action procedures.

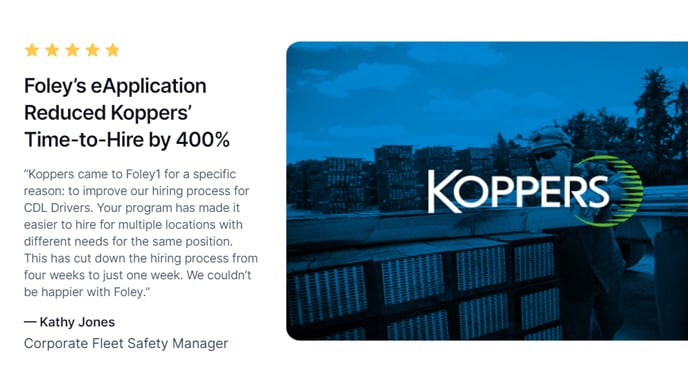

Case Study

Doru Trucking Upgrades its FMCSA Safety Rating with Foley’s MVR Compliance Checks

“If you get caught with a driver who has an expired driver’s license or medical certificate, you have an unqualified driver…and that’s a big no-no. We have Foley run an MVR after every driver’s DOT physical to make sure the updated medical card is on file.”

— Howard Orr

Director of Safety & Compliance, Doru Trucking

MVR Compliance for Regulated Industries

Place Qualified CDL Drivers Behind the Wheel

MVR checks are required during the pre-employment process and annually for DOT-regulated drivers. Fulfill your MVR compliance obligations to avoid violations and fines.

Ensure Safe Construction Equipment Operation

You wouldn’t rely on just anyone to operate your heavy equipment, so don’t approach your hiring process that way. Screen applicants for MVR violations before an irreversible accident happens.

Trust Reliable Caregivers to Transport Clients

MVR violations can be a red flag for those driving elderly clients to appointments or running errands. Uphold your healthcare agency’s reputation and the wellbeing of your patients by employing only the safest drivers.

×

Fill out this form and a member of our team will reach out shorty.

Start Running Compliant MVR Checks

Get peace of mind about your employees who drive. Submit the form below for a free MVR check program demo.

.png)

Whether you’re looking for a quick background check or a comprehensive DOT compliance solution, Foley can help.