- There are no suggestions because the search field is empty.

Hiring & Onboarding

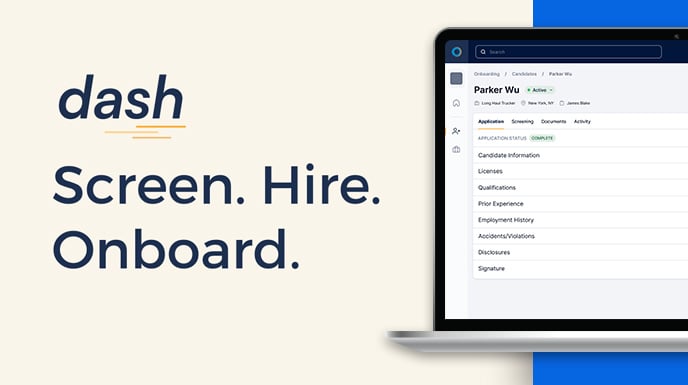

Get more applicants and streamline the employee onboarding process with Dash by Foley.

Compliance

Avoid violations, fines, and increased DOT audit risks with our advanced DOT compliance software solutions.

Data Monitoring

Unlock the power of your driver, safety, and compliance data to build a higher standard of risk mitigation.

Background Checks

Foley's background checks promote better hiring practices and give you the peace of mind you deserve.

Check Out Our Latest Product Release

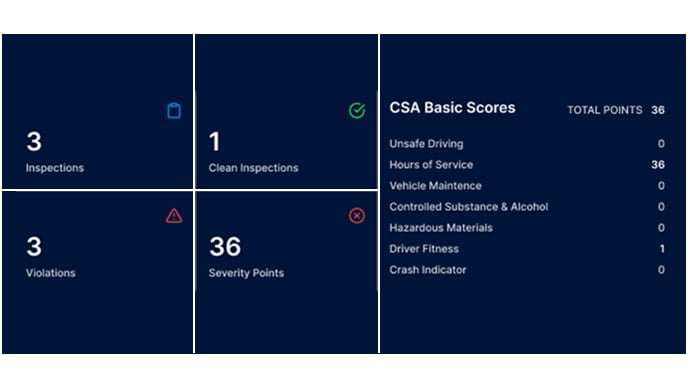

CSA Monitor tracks your driver and risk data in real time.

Learn MoreCompany Size

No matter the size of your company, Foley has the hiring and compliance solutions to help you thrive.

Initiatives

Your business goals are our purpose. Let's get more efficient, reduce risk, and grow together.

Industries

Foley's roots are planted in transportation. Over the last 30 years, we've expanded into new horizons.

Reach Your Business Goals with Dash

Foley's customizable platform for your unique initiatives.

Learn MoreCompany

Meet your new hiring, screening, data monitoring, and compliance partner: Foley.

Resource Library

Free, expertly crafted resources to help you navigate complex federal regulations and hiring practices, right at your fingertips.

Why Foley

Choosing a business partner isn't easy. Here's how Foley makes that decision effortless.

New Resources Waiting for You & Your Team

Expert, always-free resources at your fingertips.

Learn MoreHIRING & ONBOARDING

Get more applicants and streamline the employee onboarding process with Dash by Foley.

COMPLIANCE

Avoid violations, fines, and increased DOT audit risks with our advanced DOT compliance software solutions.

DATA MONITORING

Unlock the power of your driver, safety, and compliance data to build a higher standard of risk mitigation.

BACKGROUND CHECKS

Foley's background checks promote better hiring practices and give you the peace of mind you deserve.

COMPANY SIZE

No matter the size of your company, Foley has the hiring and compliance solutions to help you thrive.

INITIATIVES

Your business goals are our purpose. Let's get more efficient, reduce risk, and grow together.

INDUSTRIES

Foley's roots are planted in transportation. Over the last 30 years, we've expanded into new horizons.

COMPANY

Meet your new hiring, screening, data monitoring, and compliance partner: Foley.

RESOURCE LIBRARY

Free, expertly crafted resources to help you navigate complex federal regulations and hiring practices, right at your fingertips.

WHY FOLEY

Choosing a business partner isn't easy. Here's how Foley makes that decision effortless.

example title

example description

example title

example description